Our BIGGEST Sale!

Learn The MONEY SKILLS That Schools Won’t Teach

Piggybank Finance is for high schoolers ready to learn the money skills schools don’t teach—but life demands.

Join now to get the early access discount, entire program, practical application videos, and more! And lifetime access to everything is just $49 (Normally $349). Offer Expires Soon.

“My son learned money lessons I was never taught. ” — Karen T.

This program gave me peace of mind. I don’t worry as much about how my teen will handle money in the real world.” — Daniel L.

“My daughter now talks about saving, investing, and giving — all before college.” — James R.

Let's Face It...

Most Teens Aren’t Learning How to Handle Money

❌

Schools Don’t Teach Real-Life Money

Your teen is learning math, science, and history — but not how to budget, save, or spend wisely.

❌

Most Programs Stop at Theory

Other programs talk about “financial literacy” but don’t show teens how to actually apply it.

❌

Parents Can’t Do It Alone

You want your teen prepared, but money talks at home often lead to stress, nagging, or blank stares.

Introducing

PIGGYBANK FINANCE

✅

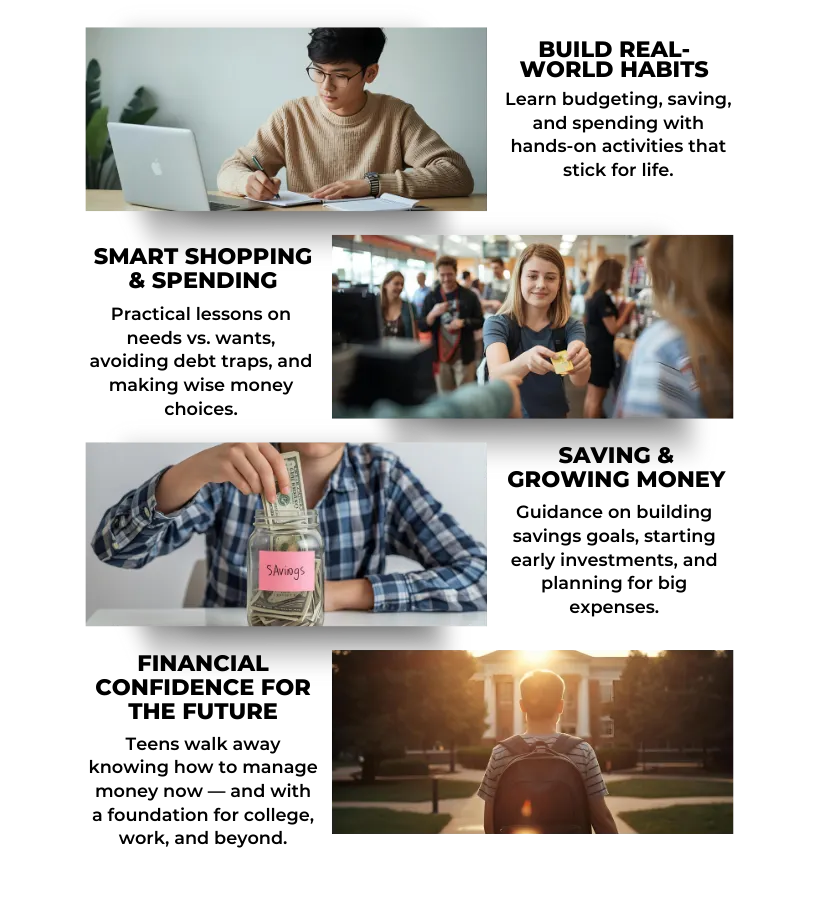

Hands-On, Practical Lessons

Instead of just theory, we guide your teen through real-world exercises like setting budgets, tracking spending, and practicing smart shopping.

✅

Skills They Use Right Away

In just 13 days, your teen walks away with money habits that stick — not just ideas that get forgotten.

✅

Peace of Mind for Parents

You don’t have to do the teaching. We make money lessons engaging so your teen learns — and you get peace of mind.

Plus So Much More!

Scroll down to see everything you get lifetime access to...

Learn How To:

Piggybank Finance

Course Curriculum

VISION

📌 What Is Financial Vision?

📌 Doers vs. Thinkers

📌 Habits for Success

📌 Overcoming Fear & Criticism

📌 Staying Humble & Content

📌 The Five Foundations

SAVINGS

📌 Why Save Money?

📌 Savers vs. Spenders

📌 Knowing Your Money Personality

📌 Investment Savings

📌 Purchase Savings

📌 Emergency Savings

SPENDING SYSTEMS

📌 Why Spending Systems Matter

📌 Needs vs. Wants

📌 Types of Expenses

📌 Income Sources & Banking

📌 Income Strategies

📌 Tracking Your Spending

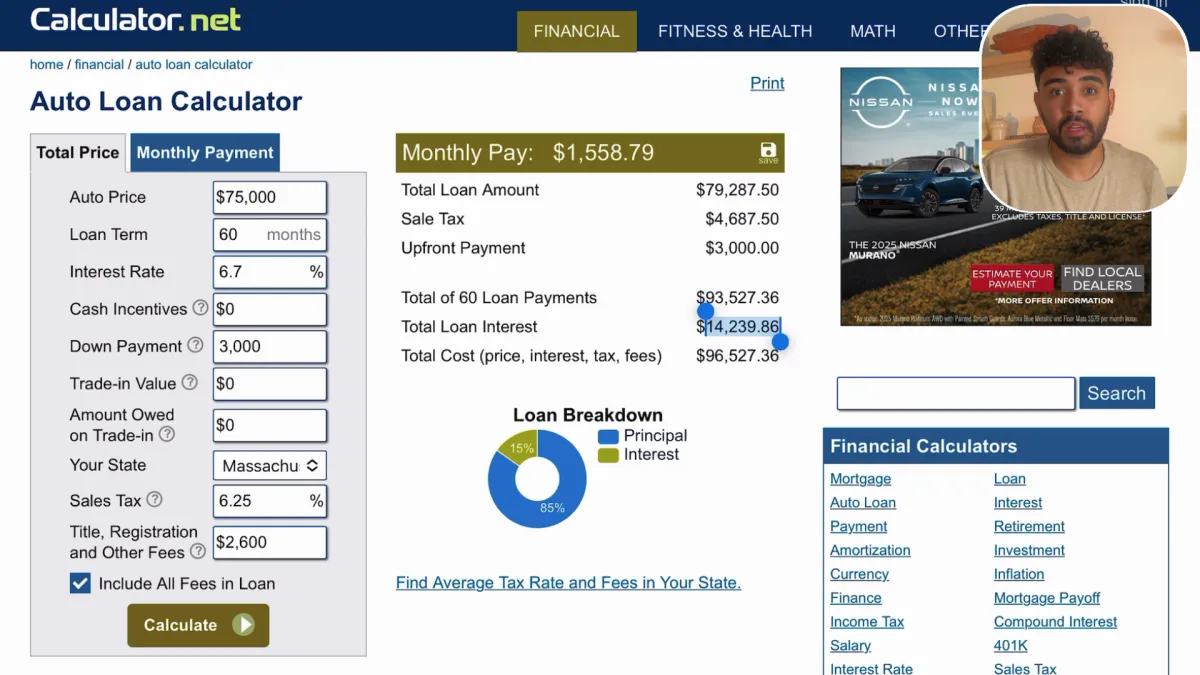

DEBT

📌 What Is Debt?

📌 Interest & Credit Cards

📌 Types of Debt

📌 Credit Score Basics

📌 Strategic Debt

📌 Smart Borrowing

SMART SHOPPING

📌 How Companies Market to You

📌 Recognizing Advertising Tactics

📌 Overspending & Debt

📌 Power Over Purchase

📌 Smart Shopping Questions

📌 Cash & Due Diligence

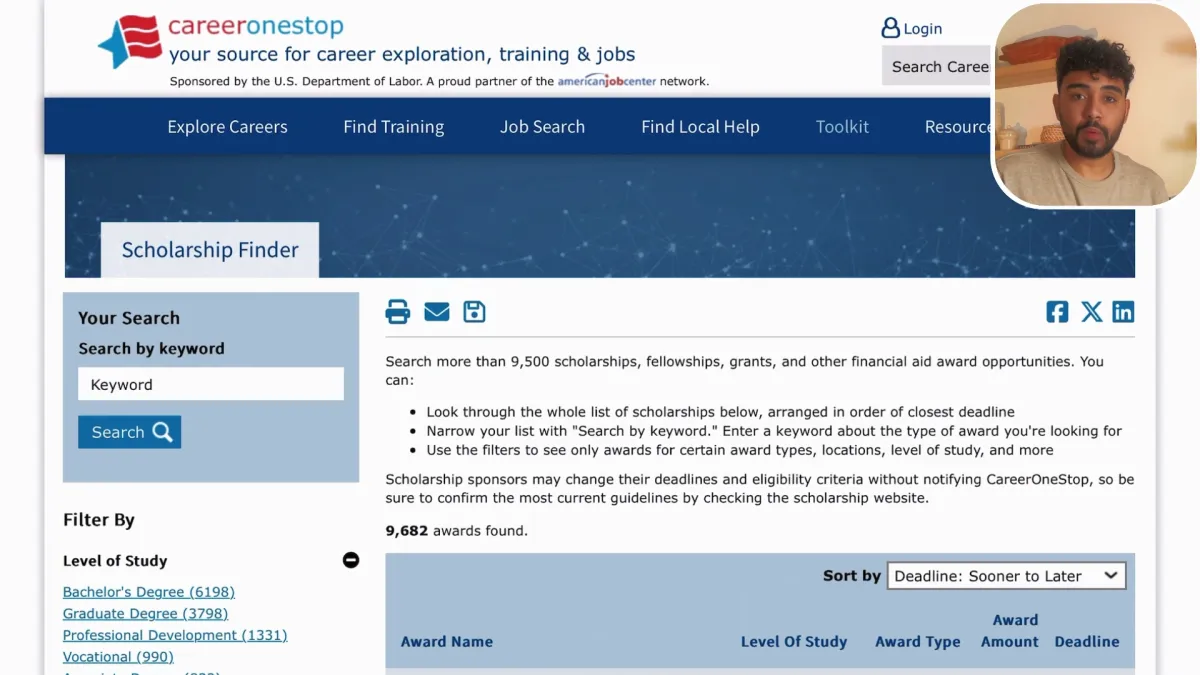

COLLEGE

📌 Why College Became Popular

📌 Is College Still Worth It?

📌 Right & Wrong Reasons to Go

📌 Degree Paths & Costs

📌 Student Loans & Grants

📌 Smart College Strategies

CAREER

📌 Self-Awareness in Career Choice

📌 Career Truths You Need to Know

📌 Career Research Factors

📌 Passion & Perseverance

📌 Entrepreneurship Basics

📌 Multiple Streams of Income

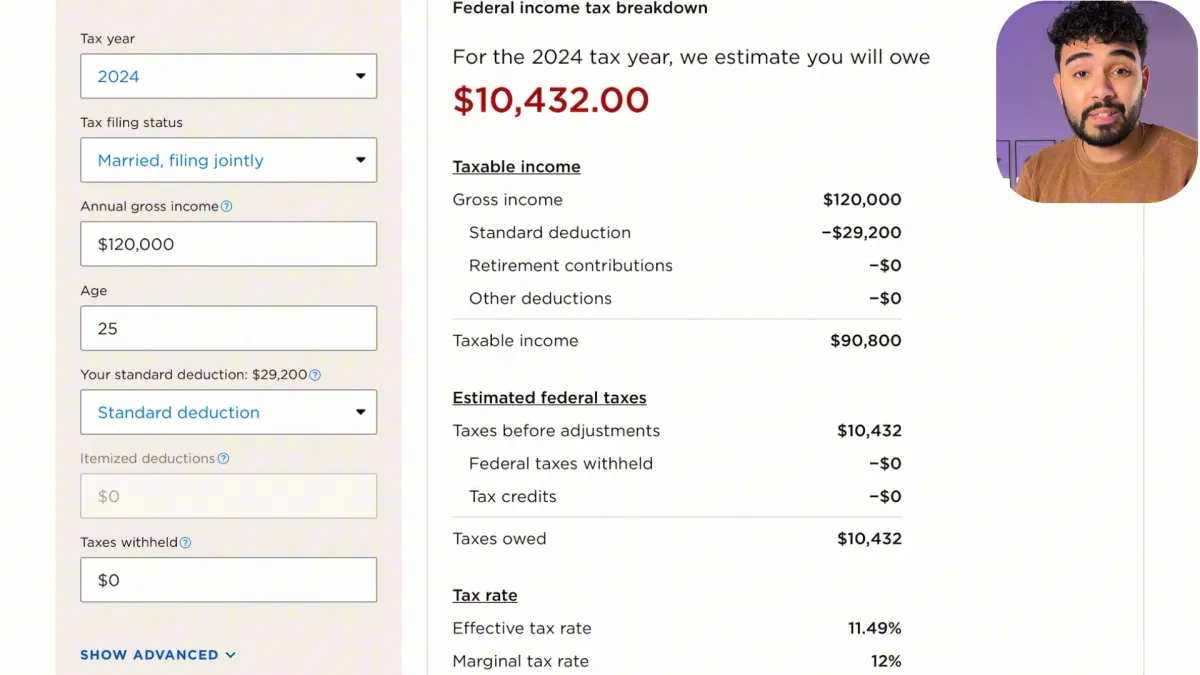

TAXES

📌 What Are Taxes?

📌 Types of Taxes

📌 Federal, State & Local

📌 Where Taxes Go

📌 Paycheck Funnel

📌 Tax Planning Basics

INSURANCE

📌 What Is Insurance?

📌 Why Insurance Matters

📌 Common Types of Insurance

📌 Key Insurance Terms

📌 Understanding Coverage & Costs

📌 Getting Professional Guidance

INVESTING

📌 Investing 101

📌 Keep It Simple (KISS)

📌 Liquidity & Diversification

📌 Types of Investments

📌 Rule of 72

📌 Passive Income vs. Capital Gains

RETIREMENT

📌 What Is Retirement?

📌 Why Retirement Matters

📌 Financial Security & Freedom

📌 Tax-Sheltered Accounts

📌 Roth vs. Traditional IRA

📌 Compound Interest

GENEROSITY

📌 Power of Generosity

📌 Fulfillment & Impact

📌 Open Hand vs. Closed Hand

📌 Simple Ways to Be Generous

📌 Generosity Beyond Money

📌 Leaving a Legacy

FINANCIAL FREEDOM

📌 Multiple Streams of Income

📌 Investment Combinations

📌 Automatic Retirement Savings

📌 Proactive Short-Term Investing

📌 Intentional Spending Systems

📌 Radical Generosity

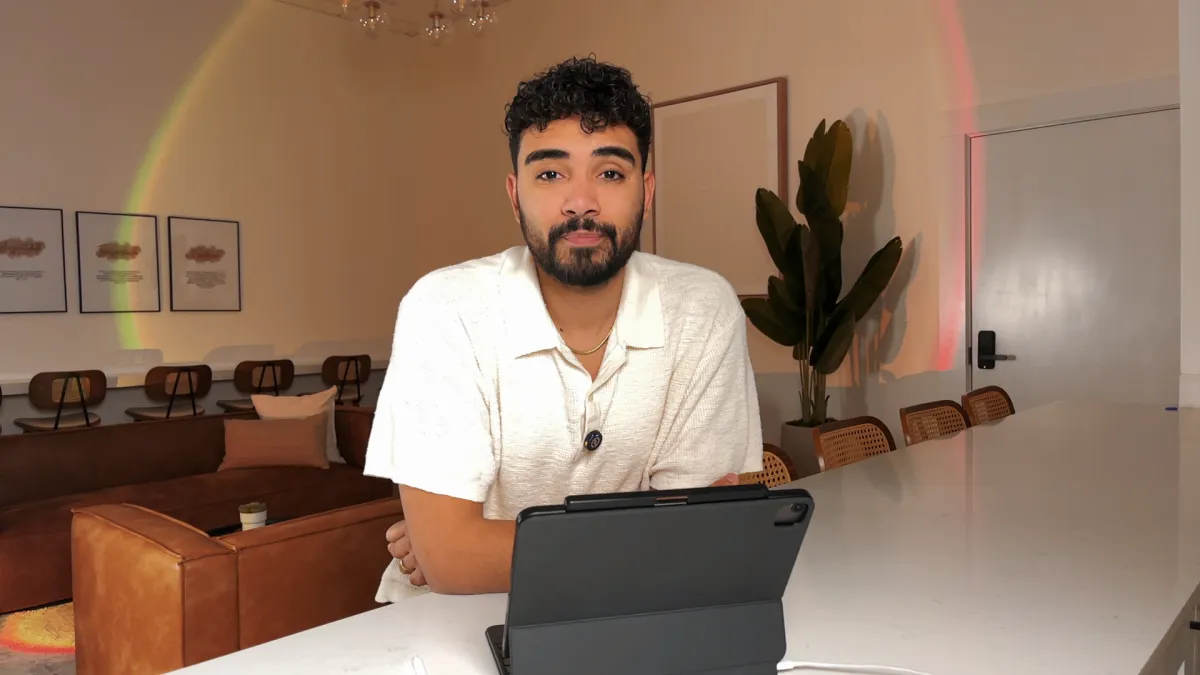

Meet Your Instructor

My name is Brunno Barbosa, and I grew up watching my mom — a single mother — work tirelessly to make things happen. She always found a way to provide, but because of the lack of financial information and tools available to her, life was often harder than it needed to be.

Like many people, I didn’t grow up with financial literacy. What I did grow up with was the desire to understand wealth, money, and opportunity. At first, I thought success meant making a lot. But the older I got, the more I realized true financial freedom isn’t about how much you earn — it’s about how you steward what’s already in your hands.

For years, I held the same limiting belief most people do: that wealth was reserved for those who were born into money or who had access to “secrets” the rest of us didn’t. But over time, I discovered that freedom with money isn’t about secrets — it’s about responsibility, discipline, and learning to make wise choices with what you’ve been given.

That realization led me to shift my focus. I wasn’t just learning for myself anymore — I felt called to help others, especially the next generation, so they could grow up with the knowledge I wish I had earlier. That’s why I created Piggybank Finance, a program that teaches teens and young adults how to master their money.

Today, I’ve had the privilege of helping students overcome those same limiting beliefs, build strong financial foundations, and step confidently into a future of freedom and literacy.

And here’s the truth: if I could do this starting with almost nothing but a hunger to learn, so can you.

Who Is This Course For?

You want to learn how to master money early and set yourself up for financial freedom.

You value practical, step-by-step tools that make money simple, not confusing.

People who are teens and young adults ready to take control of their future instead of repeating past financial mistakes.

What Categories Do We Focus On?

Students who want to learn how to manage money the right way from the start.

High schoolers and college students looking for financial independence.

Teens who want to avoid debt traps and overspending.

Young adults who want to learn about savings, investing, and building wealth.

Future entrepreneurs who want to steward money well for their business.

And anyone who wants to break free from money stress.

Who Is This Course NOT For?

You aren’t willing to take action or follow simple steps to improve your finances.

You want to keep doing things the hard way and figure it out through mistakes instead of learning from proven strategies.

You believe money is only about making more instead of learning how to steward what you already have.

Frequently Asked Questions

What skill level is this program for?

Piggybank Finance is designed for beginners with little to no financial knowledge. You don’t need to know anything about money, banking, or investing before you start. We’ll walk you step by step from the basics all the way to building habits that set you up for financial freedom. If you already know a little, this course will give you structure and clarity to connect the dots.

How long do I have access to the program & when does it start?

As soon as you enroll, you get instant access to all the lessons and activities. The course is self-paced, so you can start right away and move at your own speed. And the best part? You get lifetime access, meaning you can come back anytime for a refresher—even years down the road.

Can't I learn all of this on Youtube?

Sure, you can find random videos online, but YouTube is a mix of scattered, unorganized, and often conflicting advice. What Piggybank Finance gives you is a clear roadmap—a proven step-by-step system that actually builds your knowledge in the right order. Plus, instead of wasting hours trying to piece things together, you’ll save time, avoid mistakes, and gain the confidence that you’re learning the essentials the right way.

Do I need to have any financial knowledge before starting?

Not at all! You don’t need to know anything about money, banks, or investing before you begin. This course is built for beginners and walks you step-by-step through everything in plain, simple language. All you need is the willingness to learn and apply what we teach.

Should I invest in Piggybank Finance before I start investing money?

Yes—absolutely. In fact, this course is designed to prepare you before you ever put a single dollar into an investment. Learning the foundations now means you’ll avoid costly mistakes later. Think of Piggybank Finance as your roadmap: it gives you the confidence and knowledge to make smart financial decisions when the time comes.

Is there a guarantee?

Absolutely! Piggybank Finance has a 7-Day Satisfaction Guarantee. If you are not completely SATISFIED and ENLIGHTENED by the Piggybank Finance Program, then contact us within 7 Days for a full refund, no questions asked!